5.5 Example: KO

versus PEP and the PEG Ratio Using Consensus Analyst Forecasts

The current analyst

earnings forecasts midway through 2010 were:

From the earlier example

the Forward P/E Ratios for KO and PEP were:

Forward P/E Ratio

KO = $52.67/$3.43 = 15.36

Forward P/E Ratio

PEP = $64.57/$4.17 = 15.48

The forward P/E

ratios for these two similar stocks are similar.

Forward PEG Ratio

KO = 15.36/9 = 1.71

Forward PEG Ratio

for PEP = 15.48/10 = 1.55

The market is valuing growth more highly for KO than PEP.

Earlier 2010 KO had implemented a major shift in its

investment strategy by acquiring its bottling plants.

This brought KO in line with PEP’s investment strategy.

It was designed to

provide KO with a lot more marketing/production flexibility by

being able to more quickly respond to regional pricing and

labeling adjustments required to counteract PepsiCo’s

strategies. As a

result, the market appears to be pricing in a higher potential

for KO’s growth than was currently the case for PEP.

Did KO achieve its

potential?

In the next example we

shift forward in time and illustrate how to work with Quarterly

Financial Statements to construct current price ratios.

Valuation Tutor and Quarterly Financial Statements

In practice there are

different types of P/E ratios.

For Coca-Cola, Dr Pepper and PepsiCo:

P/E Ratio = Stock

Price/Annual Earnings per Share

Trailing P/E Ratio

= Stock Price/Sum of last four quarters

Forward P/E Ratio =

Stock Price/Forecast Earnings per Share

The advantage of the

second versus the first is timeliness.

For example, in May 2010, the first quarter financial

results are available and so the trailing four quarters are Qtr

1, 2010, Qtr 4 2009, Qtr 3 2008, Qtr 2 2009.

The third ratio looks ahead; the 1 year forecast is for

2010 covers Qtr 1 2010, Qtr 2 2010, Qtr 3 2010 and Qtr 4 2010.

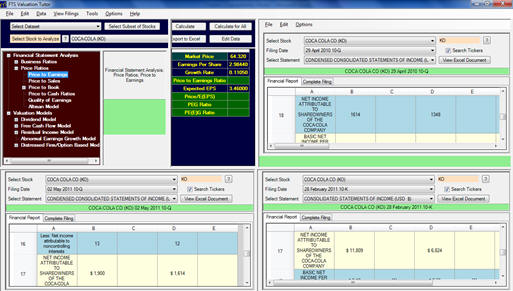

Step 1:

Click on View Filings and

select SEC Filing Viewers at Bottom and then select SEC Filings

Viewer at Right.

This lets you bring in the required three statements

simultaneously.

Step 2:

Filing Date select the following three dates

respectively.

02 May 2011 10-Q (3-months

ending April 1, 2011);

28 February 2011 10-K (12-months ending Dec 31, 2010);

29 April 2010 10-Q (3-months ending April 2, 2010)

Trailing Twelve Months

(TTM) = April 1, 2011 (3-months) + (Dec 31, 2010 (12-months) –

April 2, (3-months);

Computing TTM Net Income

Attributable to KO Shareholders = $1900 + ($11,809 - $1,614) =

$12,095.

June 30, 2011 KO closed at

$67.29 per share and from the 10-Q Balance Sheet for April 1,

2011 the latest estimate of shares outstanding was:

3,520 less Treasury Stock equal to 1,233 = 2,287

The TTM EPS =

$12,095/2,287 = $5.2885

P/E (Trailing 12-months

June 30, 2011) = 67.29/5.2885 = 12.72.

The consensus 5-year’s

growth forecast for KO around this time 9.0% and so the PEG

ratio is:

PEG (Trailing 12-months

June 30, 2011 = 12.72/9.0 = 1.41.

Since the earlier example,

KO’s stock price has increased along with its earnings.

Overall current P/E ratios have fallen including the PEG

ratio.

Suggested Exercise:

Compute the TTM P/E and PEG ratios for PepsiCo and Dr

Pepper Snapple to assess which stock is relatively cheaper.

PEP’s 5-year growth forecast is 8.3%, June 30 closing

price = $70.43 and DPS is 10.5% and June 30 closing price =

$41.93.